Cashflow - Budget and Planning

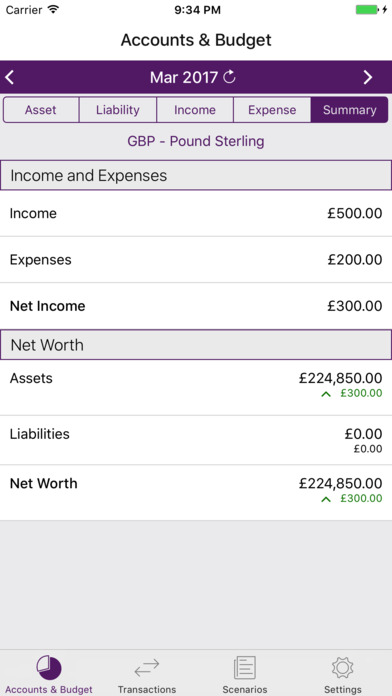

Cashflow budget and planning app helps you plan your income and expenditure and gives you an idea of how they affect your assets and liabilities such as bank accounts, credit cards and mortgages.

It aims to help you answer questions such as: will my future cashflow leave me with enough money to carry out a certain project at a certain time in the future? How would I manage if I get a bonus lower than I got last year?

The key features of cashflow include:

- Accounts: Ability to manage asset and liability accounts as well as income and expense budget categories in any currency. It comes with in-built support for mortgages.

- Transactions: Ability to manage transactions that move money between accounts. Both one-off and recurring transactions are supported. You can also manage arbitrary transfers between accounts, e.g. to pay off a debt (liability) from a cash account (asset).

- What-if Scenarios: Ability to organise transactions into scenarios that may or may not occur. Using this, you can see the effects of your cashflow depending on whether or not an event occurs.

When you install cashflow for the first time, it comes with a simple set of accounts, some transactions and scenarios to get you started.